Yes, the title says “mandate”. For this new year we need a new mandate—marching orders given to ourselves. Then 2021 will be a new start toward a wealthy future. Let’s Go!

The Mind Dump

We’ll begin by clearing the clutter and creating a space to work our new strategy. Get everything out of your head and onto a blank sheet of paper (sort of mind mapping here). Place these concerns in a mental “parking lot”, off to the side to be addressed in future discussions, when we actually create a plan.

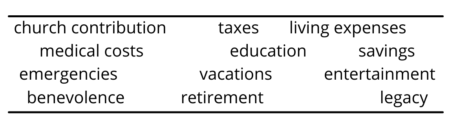

The following represent the rough categories that I’m dumping onto my parking:

Use my list as a starting point and create your own written list. Omit any items that don’t apply. Don’t place any order or priority on anything, just post them on your parking lot off to the side. Now let’s roll up our sleeves and get started.

Begin with the End in Mind!

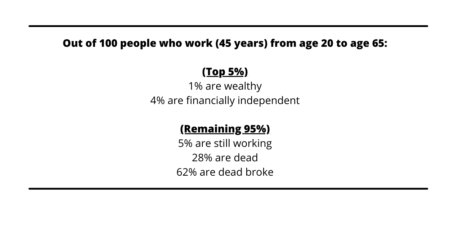

Through my studies I have found some shocking information about where the average person will end up financially. For the most part our money is directly tied to working. The chart below shows what Americans can expect from our labor:

Obviously, our clear mandate is to get in the top 5%, or the top 1% (going all the way to wealthy)! This is the end that we now have in mind after seeing the frightening truth. So, let’s sketch out good, clear, actionable first steps.

Stated simply, we want to know two things:

- What are the top 5% doing? What’s the secret?

- What do the bottom, 95% fail to do?

I want to address the bottom categories first. Here we find that 5% are “still working”—some by choice but many work well into their 60’s and 70’s and beyond out of necessity. The next two categories, sadly, make up the largest demographic: the “dead” and the “dead broke”. A whopping 28% don’t live past age 65! Maybe money played a role in their demise, as they lacked the funds to acquire necessary health care services. (Just a thought!). Clearly those in the “dead broke” (62%) category outlived their earnings, income, savings, investments and assets. We want to avoid these deficiencies by avoiding the habits of the bottom 95%.

Instead, we want to examine and follow the habits and practices of those who are successful. The important question becomes: What are the top 5% doing? We might automatically assume that many of these were born into wealth, but research does not support this assumption. In fact, often people who come into great wealth, through inheritance or some other means, are likely to fritter it away and end up broke. But the top 5% have usually developed financial strategies which create life-long wealth. This news encourages all of us because it means that everyone has a chance to become wealthy or at least financially independent. We just need to learn and follow the practices of the top 5%. And here’s what they do:

- They study both wealth and poverty. As obvious as this step may seem, most people have never stopped to study wealth. Money, finances, asset accumulation, income and investments are rather vague terms for us. We rely on those who are trained and educated as advisors to explain these concepts, but we fail to dig in and study the topics for ourselves. And when do we ever actually study poverty? What habits create poverty—in our world? In our country? In our homes? What factors are within our control? What factors are not within our control? What safeguards do wealthy people put in place that the bottom 95% do not? Our starting point is to become students of wealth and poverty.

- They work in community. No one reaches the top 5% by working alone. No one can study enough to acquire all the knowledge needed to succeed. No one can make enough mistakes in one lifetime to learn the necessary lessons. Working together allows us to accelerate everyone’s learning curve as we learn from each other. In addition, we need to find the right wealth systems, develop the right mindset and obtain enough motivation to stay on track. The top 5% work in community with others who are focused on the common goal of building wealth.

- They write out a plan. The research is clear and indisputable: those with a written plan are 97% more likely to reach their goals, than those who refuse to commit their hopes, dreams, strategies and schemes to writing. A physical, written plan is the first step to making the dream a reality.

- They follow their own plan. Nothing happens until we take decisive action. Many in that bottom 95% actually develop a plan every new year. But the victorious ones in the top 5% write out the plan, take action throughout the year, review and modify the plan regularly and roll the plan forward year after year –for 45 years or until the end goal is accomplished.

The end goal is to acquire enough to live a fulfilled life and leave a lasting legacy. Good health and adequate wealth in retirement is required to attain this goal. We commonly think of retirement as beginning at age 65—but what if it’s 55? or 45? or even 25? Retirement has little to do with age, but everything to do with money!

Question: What mandate have you set for yourself? Are you ready to work within a community to study wealth, develop your written plan and take action–beginning on this date in 2021? If so, you are headed for the top 5%–your wealth mandate.