Happy New Year and best wishes for a healthy, abundant and prosperous year! Let’s make a commitment this year to set our goals to continually improve our Financial House and take active steps to reach our goals and hopefully exceed them! Most of us usually start our year with goal setting for the key aspects of our lives, depending on where we are in our life’s journey. We can start planning in our twenties, and keep moving till we are in our nineties!

When we look inside our Financial House, we may review our year-end income, our retirement accounts, our credit card debt, our remaining college loans, car loans, among other financial data, and we take a look at the bigger picture of where we are and where we want to go. Sometimes, when we look at the longer term, it may bring us a little fear and anxiety. Fear around how do we get from here to there, with a goal and take steps to achieve it? Or we may “self-talk” ourselves out of a bigger goal and perhaps, an even brighter future! So often, we can track our financial records for tax purposes to appease the IRS, however, we may not take the bigger step to put our Financial House in order now to improve our lifestyle for ourselves and our family for the future. Promise yourself, that you will step boldly into your 2018 Financial House with bigger goals for a brighter future!

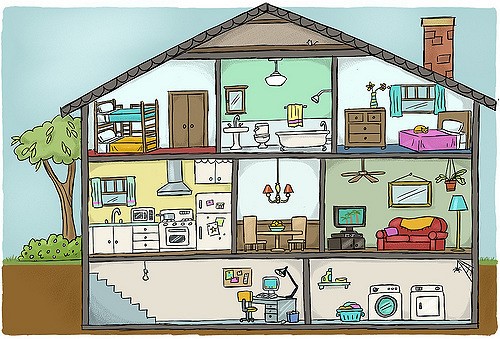

Let’s break this down, using our “house” analogy, with kitchens, bedrooms, bathrooms, living room, etc. Let’s make the kitchen the center of our home, and that’s where the income flows in and the lifestyle expenses flow out. That’s our monthly budget area. In the beginning of the year, please do review and check your income and expenses and see where you may be able to save more whether for retirement, college, or that special vacation.

As we take our house tour, let’s use the bedrooms as our wealth accumulation rooms: Bedroom 1 is our emergency savings; Bedroom 2 is our retirement account(s); and Bedroom 3 is our college savings/ or specialty savings accounts. As we mature and travel on our life’s journey, you may add more bedrooms that house your wealth accumulation accounts, such as permanent life insurance, long term care accounts, annuities, employer pensions, etc., etc. The more bedrooms we have the better!

Continuing with our Financial House analogy, let’s use the family room as our Wealth Protection area, where we take care of our home/apartment insurance, car insurance, our health insurance, and life and disability coverages, as we bring those online to protect ourselves and our families. In our work with our clients, we take great care to make sure that your family room is properly constructed and cared for throughout your life’s journey. Please read your coverages, as you don’t want to have an emergency like a fire, where you home is destroyed, and your insurance coverage will not be sufficient to re-build.

Let’s use the Living room, for our investment strategies, retirement planning and building our family legacy. While your savings are managed in the bedrooms areas by type, we need to have an overall strategy and plan for our Second Act (also known as retirement lifestyle). This is where we house our life and lifestyle plans for our Second Act, and our family legacy. For some, this room will be used sparingly, as you are young and building your Financial House. For others, you may be sitting and enjoying this room as we speak, experiencing the joys of retirement or a Second Act, where you can work on your purpose and passion, whether as a volunteer or a paid gig. In this room, we also establish our family legacy by ensuring that we write our wills/trusts as appropriate to pass on our hard-earned wealth to our family and the causes that we care about deeply.

We have had some fun using the Financial House analogy, and we urge you to take small steps in early 2018 to outline your big dreams, your goals to increase income and decrease debt, to buy your first or second home, or to start a college savings plan for your new baby. There are many ways to take small steps to secure your future and improve your Financial House. When you take one small step for yourself, many more will be taken on your behalf. Try it and you may love the result!

Happy New Year to you all!